Story Protocol (IP): Bullish Growth Potential in the 2025 Web3 Surge

Introduction

The 2025 crypto bull run has ignited excitement around Story Protocol ($IP), a new Web3 project aiming to revolutionize intellectual property rights on the blockchain. Story Protocol’s layer-1 network for programmable IP is gaining traction as creators and developers seek better ways to monetize content in an AI-driven era. Backed by top venture capital (like a16z) and fresh off a successful mainnet launch, $IP has quickly entered the top 100 crypto ranks by market cap. With the broader market rallying and narratives like AI and Web3 convergence in full swing, many see Story Protocol as a high-upside contender in 2025. Let’s dive into what Story Protocol is, why the outlook is so bullish, and what price trends and predictions suggest for the short and long term.

What is Story Protocol (IP)?

Story Protocol is a purpose-built blockchain for intellectual property (IP) management in the Web3 era. Think of it as the infrastructure for owning, licensing, and monetizing creative content on-chain. Built as its own layer-1 (combining Ethereum Virtual Machine compatibility with Cosmos SDK performance), Story Protocol lets creators tokenize any form of IP – whether it’s an idea, image, song, or even AI-generated content – as a unique NFT-based asset called an “IP Asset.” Each IP Asset is tied to a token-bound account (using the ERC-6551 standard), which stores programmable rules for how that IP can be used or remixed. This means licensing agreements, royalty splits, and usage permissions are all automated by smart contracts. For example, an artist can register a digital artwork on Story and set it so that if someone uses it in a game or AI training, the smart contract automatically enforces a royalty fee back to the artist.

In short, Story Protocol provides the Web3 IP infrastructure creators have been waiting for: a transparent, decentralized system to protect creative rights while encouraging collaboration. In an age where generative AI can remix content in seconds and traditional copyright laws fall behind, Story offers a new solution. By moving IP rights on-chain, it enables “programmable IP” – making it easy to prove ownership, trace derivatives, and ensure original creators get paid. This positions Story Protocol at the heart of a $60+ trillion global IP market poised for disruption.

Why Story Protocol Could Soar in 2025

Multiple factors are fueling a bullish outlook for $IP in this bull market:

Innovative Tech & First-Mover Advantage

Story Protocol is pioneering a novel concept – an “IP blockchain”. Its use of token-bound accounts (ERC-6551) and Programmable IP Licenses (PIL) is a game-changer for the creative economy. This level of on-chain IP programmability hasn’t been seen before, giving Story a first-mover advantage in a huge untapped niche. As AI-generated art, music, and content explode, Story’s solution for tracking and monetizing those creations gives it strong narrative momentum (AI + blockchain + creator economy is a powerful combo). Projects with unique narratives tend to perform exceptionally well in bull runs, and Story fits the bill.

Strong Token Utility and Tokenomics

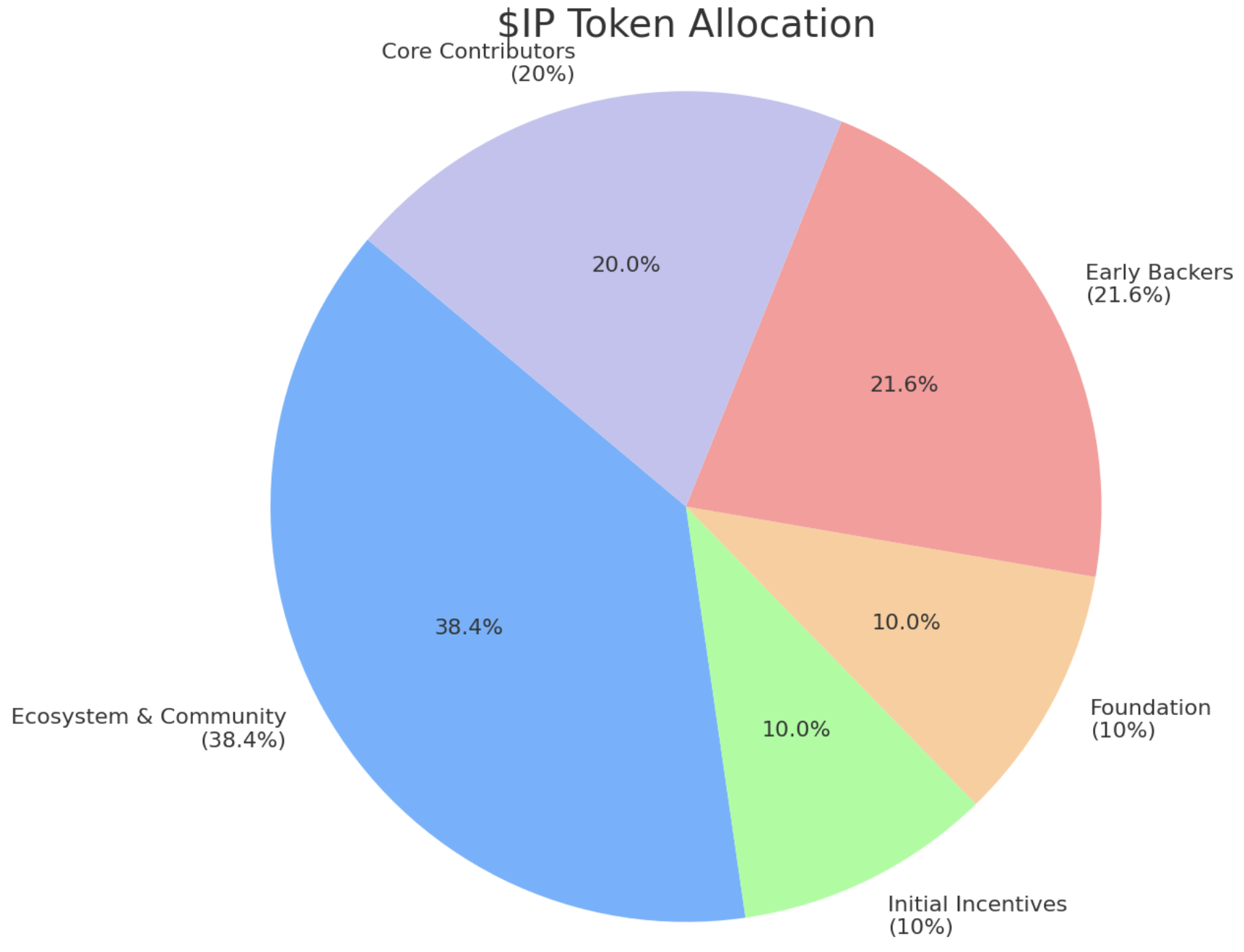

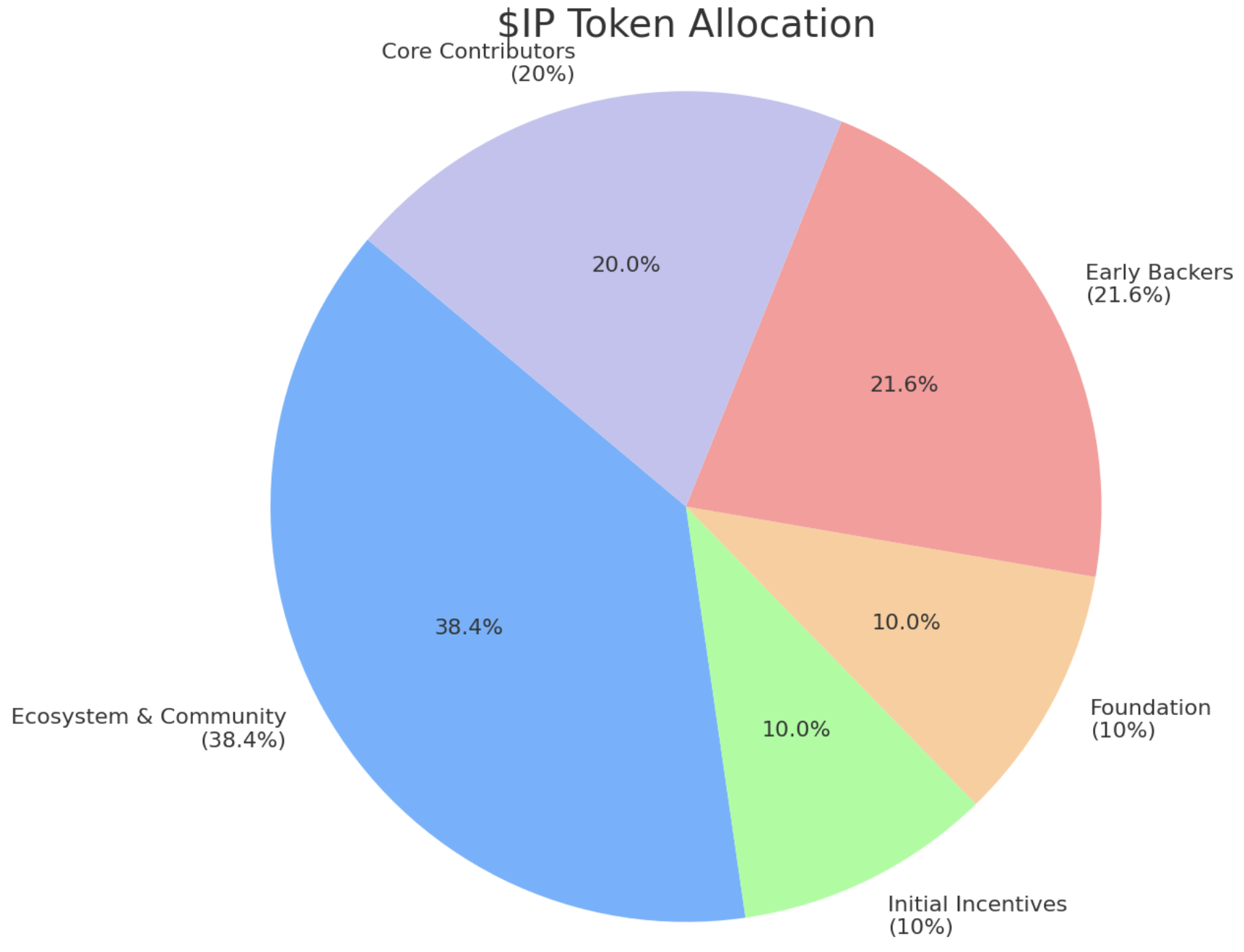

The $IP token isn’t just a governance coin – it’s the lifeblood of the Story ecosystem. $IP is used for transaction fees (e.g. registering IP, executing licenses), staked by validators to secure the network (Proof-of-Stake), and used in governance votes for protocol upgrades. Importantly, creators may also use $IP within the platform to set licensing terms or stake for higher visibility, adding to its demand. The tokenomics are designed for sustainable growth: out of a 1 billion total supply, only 25% was unlocked at launch (with ~280M $IP circulating in mid-2025). The rest is allocated to support long-term development – with 38.4% for ecosystem & community growth, 10% for user incentives, 10% to the foundation, 21.6% to early backers (locked over 4 years), and 20% to core contributors. This balanced distribution (see chart below) means the team and investors are vested long-term, while a large chunk is reserved to attract developers and users. As adoption increases, $IP’s built-in utility could translate into rising demand, all while supply release is gradual and planned.

$IP Token Allocation – a balanced distribution focusing on ecosystem growth (largest share), with long-term vesting for team and backers. Token utility (fees, staking, governance) drives organic demand.

Developer Traction & Ecosystem Growth

Story Protocol has been rapidly attracting developers and partners to build out its ecosystem. Even before the public mainnet, it launched on testnets and collaborated with Web3 builders. For instance, Story partnered with the AI startup Ritual to help AI developers register and track their generative models’ outputs on-chain – a proof of concept that Story can serve emerging AI dApps. It’s also integrated with tools like MyShell (a platform for building AI chatbots), allowing creators there to secure their AI models as IP Assets on Story. On the creative side, Story teamed up with art platform Magma to empower digital artists with on-chain IP licensing. These early collaborations signal real developer interest in Story’s protocol. The network is EVM-compatible and cross-chain friendly (thanks to Cosmos tech), making it easy for Solidity devs and others to join. As more devs experiment with IP-based dApps – from NFT remix marketplaces to AI content platforms – Story’s ecosystem could snowball, drawing in even more users and boosting $IP usage.

Major Backing and Partnerships

Confidence in Story Protocol runs high among industry leaders. The project has raised over $130 million in funding, including a $29M seed and $25M Series A in 2023 led by Andreessen Horowitz (a16z), followed by a whopping $80M Series B in August 2024 (again led by a16z). Such backing from a top-tier crypto VC not only provides capital for development but also validates Story’s vision. Even celebrities and media figures have taken note – Paris Hilton’s 11:11 Media fund invested early, seeing potential in Web3 IP. On the partnership front, Story isn’t just sticking to crypto circles; it’s collaborating with academia and AI research heavyweights. In early 2025, Story Protocol announced a partnership with Oxford University to advance “Agent TCP/IP,” an initiative exploring how AI agents can autonomously negotiate and trade IP assets on-chain. The idea of AI bots buying/selling licensed data using Story’s protocol is futuristic – and exactly the kind of bold innovation that grabs headlines. Together, these investments and partnerships give Story both credibility and access: credibility in that experts believe in it, and access to networks of creators, developers, and even researchers who can amplify its adoption.

Roadmap Execution & Upcoming Catalysts

Story Protocol’s team has delivered on key milestones and has an ambitious roadmap for 2025 and beyond. Mainnet launched in Q1 2025 (on February 13, 2025 to be exact), complete with an airdrop to early community members, which put $IP in circulation and kickstarted the network. In Q2 2025, the team rolled out the IP Portal (public beta) – a user-friendly hub where anyone can seamlessly register their IP assets and browse content registered across various apps on Story. Alongside, a Story Attestation Service debuted in beta, bringing a decentralized oracle network to verify on-chain IP data (like checking creator identities or detecting plagiarism). Looking ahead to late 2025, the project plans a major network upgrade focusing on performance (higher throughput, faster transactions) and further decentralization (adding more community-run validator nodes). These continual improvements show a commitment to scalability and security as usage grows. Beyond tech upgrades, more real-world use cases are likely on the horizon – think brands protecting their content, game developers trading IP, or streaming platforms integrating Story for rights management. Each new integration or feature can act as a catalyst for $IP demand. The bottom line: Story Protocol is not vaporware; it’s shipping product and expanding, which bodes very well in a bull market where execution is rewarded.

$IP’s Rollercoaster Price History

Like many hyped new tokens, $IP has seen wild price swings in its early life. The coin launched on exchanges in mid-February 2025 around the time of mainnet launch, initially priced near $1.00 (with many tokens claimed via airdrop by early users). Within days, intense buying pressure drove $IP up over $7, marking an all-time high by late February. This ~600% surge in a week made headlines and put Story Protocol on the map as one of the top-performing new crypto assets of the year. What fueled the spike? The combination of bull market optimism, low initial circulating supply, and excitement over Story’s roadmap likely all played a role. News of the upcoming IP Portal and oracle service in Q2 2025 also added to the FOMO.

However, early rallies often face corrections. After peaking above $7.3, $IP experienced a pullback as traders took profits. Over the next couple of months, the price retraced and stabilized in the $4 range. By mid-2025, $IP hovers around ~$4. This is still well above its launch price, reflecting that bullish momentum held strong despite volatility. Essentially, $IP had a classic “pump and settle” debut: initial euphoria, then finding a baseline once the market cooled slightly. The token’s market capitalization currently sits around $1.1 billion, placing Story Protocol firmly in the top 70–80 projects – an impressive feat for a project barely a few months into mainnet.

IP Token Price History – from a $1 launch to a $7+ surge and a healthy consolidation around $4 by mid-2025. The initial spike highlights the excitement around Story Protocol’s launch and roadmap, followed by a natural retracement as the market found equilibrium.

This rollercoaster price history shows that $IP can rally hard when momentum is behind it. It’s also a reminder that new tokens are volatile; early investors have already seen huge gains and steep dips. Yet, the fact that $IP has maintained levels several times its initial price indicates real conviction in the project. Now, with the token’s early price discovery phase behind it, traders and analysts are looking ahead to where $IP might go next in this bull cycle.

Short-Term Price Predictions (2025–2026)

With Story Protocol back in the spotlight and the 2025 bull run accelerating, what do analysts think $IP could be worth in the next year or two? Price predictions are always educated guesses (and not financial advice!), but the short-term sentiment for $IP is optimistic if current trends continue. Let’s break down some forecasts for 2025 and 2026, along with the reasoning behind them:

2025 Price Targets

Many forecasters see Story Protocol climbing further by late 2025 as its platform gains users. Conservative estimates for end of 2025 put $IP in the $5–$8 range. These assume steady growth of the Story ecosystem (more IP assets, a few high-profile partnerships) without any explosive viral adoption. On the more bullish side, some crypto enthusiasts on forums speculate that if the 2025 bull market is truly massive, $IP could potentially reach double-digits, perhaps testing the $10–$12 zone by year-end. This optimistic scenario would likely require Story Protocol to exceed expectations – for example, a surge in on-chain IP registrations or a major company announcing they’ll use Story for content licensing. A mid-ground prediction from one crypto research outlet suggests ~$7–$9 as a reasonable target by Q4 2025, which assumes the overall market stays hot and Story continues delivering news and improvements.

Justification (2025)

The reasoning for $IP’s growth this year centers on increased usage and bull market conditions. In a broad crypto bull run, capital tends to flow into strong narrative coins – and Story hits multiple hot narratives (Web3 infrastructure, AI, NFTs). If Bitcoin’s post-halving rally lifts all altcoins (as history often shows), $IP stands to benefit. Specifically, look at user adoption: by end of 2025, Story’s IP Portal and partnerships could bring thousands of creators and developers onto the network. Each new participant potentially means more demand for $IP (for fees, staking, etc.). Additionally, the supply dynamics are favorable in the near term; with a quarter of supply circulating and major investors likely holding long-term, sell pressure is somewhat limited while new buyers enter. Technically, if $IP can break above its post-launch trading range (clearing resistance around $5–$6), that could trigger the next leg up as momentum traders pile in. Overall, as long as the crypto market remains upbeat through 2025 and Story shows tangible growth, the short-term bias for $IP is bullish. Volatility will persist, but dips might be seen as buying opportunities by those who believe the project’s best days lie ahead.

2026 Outlook

Looking into 2026, most predictions continue the bullish trajectory but at a more measured pace (especially if 2025 ends with a blow-off top rally). Various crypto price models project $IP in the $8–$15 range during 2026. A moderate scenario could be $IP averaging around $10–$12 in 2026 – essentially holding onto its 2025 gains and perhaps growing a bit more as the platform matures. More optimistic forecasters – assuming Story Protocol really catches fire by then – float the idea of $IP reaching high teens (say $15–$18) by the end of 2026. This would likely require that Story becomes a widely used backbone for IP transactions across multiple industries (not just crypto art, but maybe music rights, gaming IP, etc.). There are even whispers of $IP possibly doubling its 2025 highs if the Web3 creator economy booms – that means targets above $14, which, while aggressive, aren’t impossible in a euphoric market. On the cautious side, some algorithmic predictions show a plateau or slight dip in 2026, especially if 2025’s bull run was huge (the idea being that 2026 could see a cooling-off or mini-bear). Even those conservative models, however, tend to keep $IP well above today’s price (often still in mid-single digits at worst).

Justification (2026)

By 2026, the hype cycle will need backing by real usage metrics. The optimistic case is that by then, Story Protocol will have a thriving ecosystem: perhaps dozens of dApps, tens of thousands of IP assets registered, and maybe some revenue-generating use cases (like popular NFT marketplaces or AI content platforms paying royalties via Story). This kind of traction would firmly establish a valuation floor for $IP due to fundamental demand. Also, 2026 might be a year where crypto as a whole either consolidates or enters a mid-cycle; if it’s the former, investors will be picky – and a project with actual adoption like Story could stand out and retain value. Watch for how token unlocks are handled too: early backer tokens will still be vesting through 2026, but if they remain committed or tokens get redeployed into the ecosystem, the impact could be minimal. Any technical breakthroughs or big partnerships announced in 2026 (say, integration with a major media franchise or a government using Story for digital IP registries) would of course be wildly bullish catalysts. All in all, the 2026 outlook for $IP largely depends on execution – but current signs (funding, roadmap progress, community growth) give reason to believe Story Protocol will keep the wind at its back moving into 2026.

Projected $IP Price Trend (Short-Term) – An illustrative scenario of $IP rising from roughly $4 in mid-2025 to the $10+ range by the end of 2026. This assumes continued bull market momentum and growing adoption of Story Protocol’s platform through the next year or two.

Long-Term Outlook (2027–2028 and Beyond)

Thinking further ahead, what might Story Protocol be worth in a few years if it truly fulfills its vision? Predicting crypto prices out to 2028 is certainly speculative, but it’s a useful thought exercise to consider $IP’s long-term potential. If Story Protocol becomes foundational to Web3’s creator economy, the upside could be significant. Here are some long-term price musings and the factors that could drive $IP by 2027–2028:

2027 Expectations

By 2027, Story Protocol will either have proven its utility as critical Web3 infrastructure or faded away – and at this point, sentiment leans toward success. A number of long-range forecasts see $IP continuing an upward trajectory into 2027. For example, one optimistic analysis puts $IP in the $15–$25 range in 2027, meaning it would handily surpass its previous highs as the project matures. Even more conservative predictions land in the low double-digits for 2027 (say $10–$15). The general idea is that if Story Protocol thrives over the next few years, by 2027 it could be a much larger ecosystem with mainstream recognition, thus commanding a higher token price. It’s also worth noting that 2027 could align with another major crypto market cycle peak (following the typical four-year cycle after 2025’s bull run). If so, that macro tailwind could amplify prices across the board – including $IP. In a peak cycle scenario, seeing $IP push past $20 in 2027 isn’t off the table.

2028 and Beyond (The Moonshot Scenario):

Looking at 2028 and onwards, some analysts aren’t shy about setting bold targets for Story Protocol if all goes exceedingly well. There are projections of $IP reaching $30+ by 2028, with a few extreme bullish cases even hinting at the $40–$50 range longer-term. Why such big numbers? If by 2028 Story Protocol truly becomes the global standard for registering and trading IP rights – imagine major studios registering film IPs on-chain, global artist communities using Story for licensing, or AI companies relying on Story for dataset provenance – then $IP would have massive real-world utility and demand. In that scenario, Story could be a top-tier crypto project by market cap, possibly in the same conversation as today’s leading smart contract platforms. For context, a price of ~$30 would imply a market value in the tens of billions (given the supply), which, while ambitious, might be justified if Story underpins a significant portion of the digital content economy. On the more cautious side, not everyone foresees a moonshot. Some long-term models project a more modest $10–$20 range for 2028 if growth is steady but not explosive, factoring in competition and the natural saturation of the market. These models assume that while Story will grow, it might share the space with other IP or content-focused protocols by then, which could cap its upside. Still, even those tempered predictions put $IP above current prices, reflecting a generally positive long-term outlook.

Justification (Long-Term):

The long-term trajectory for $IP boils down to adoption and integration. By 2027–2028, if Story Protocol is widely adopted, it could benefit from network effects – more creators registering IP begets more content for others to remix and license, which attracts more developers to build on the platform, and so on. A virtuous cycle of growth would cement Story’s position and drive continual token demand. Additionally, external factors could boost Story’s prominence: For instance, if regulators or courts start recognizing on-chain IP records as valid (or if new copyright frameworks emerge for AI-generated work), Story’s early mover advantage could make it the go-to solution. Another factor is competition – while Story is first, it’s likely not the last in blockchain IP. If it manages to outpace or absorb potential rivals by 2028, that would greatly strengthen its market share and token value. Conversely, strong competition could limit $IP’s market capture, one reason some forecasts stay moderate. Technologically, the protocol will need to scale efficiently by 2028 (handling potentially millions of IP assets and transactions), but given the team’s focus and funds, there’s confidence here. Essentially, the moonshot scenario for $IP in 2028 requires that Story Protocol becomes as important to digital content as something like Ethereum is to DeFi today – a backbone infrastructure. It’s a tall order, but it’s also the kind of ambitious vision that crypto bull markets love to bet on.

Illustrative Bullish Outlook for $IP (2025–2028) – In a potential optimistic scenario, $IP could climb into the $20+ zone by 2028, riding on widespread adoption and the growth of on-chain IP markets. While this is speculative, it highlights the significant upside bulls are eyeing over the long run.

Conclusion

Story Protocol’s journey is just beginning, but it’s already shaping up to be one of the most intriguing projects in Web3. By tackling a massive real-world problem (IP rights in the digital age) with cutting-edge blockchain tech, Story has put itself at the crossroads of major trends: the boom in AI-generated content, the rise of NFTs and digital collectibles, and the push for decentralization in creative industries. The current crypto bull run has shone a spotlight on $IP, and much of the sentiment is bullish – with good reason. Story Protocol blends a visionary idea (a global registry and marketplace for creativity) with concrete progress (mainnet live, active partnerships, strong token utility). Its price history shows it can capture market imagination and rally hard, and recent developments suggest the project has real momentum heading into late 2025.

Is $IP guaranteed to be the next big thing? Of course not – nothing in crypto (or life) is guaranteed. There are risks: technological hurdles, user adoption uncertainty, and competition can all influence outcomes. But the bullish caseenvisions Story Protocol becoming a foundational piece of the creator economy’s future infrastructure. If that happens, the value of $IP could be far higher than it is today. In the short term, traders are watching key levels (can $IP reclaim $7+ and turn it into support? Will it break into double-digits with enough hype?). And in the long term, believers are dreaming of much larger milestones – potentially $20, $30, or beyond by 2028 – if Story truly conquers the Web3 IP space.

For now, it’s safe to say Story Protocol has graduated from launch-phase obscurity to a strong contender on investors’ radars in 2025. It’s bold, unproven, but full of promise – exactly the kind of project that crypto bull markets are known to elevate. Whether you’re excited by its mission to empower creators or you’re simply on the hunt for the next high-upside altcoin, $IP is a token worth watching as this bull run unfolds. As always, remember to do your own research and consider your risk tolerance – the crypto arena is volatile, and even the brightest stories can have twists and turns. But with innovation alive and well in projects like Story Protocol, the 2025 market surge is writing an exciting new chapter for Web3. Happy investing, and enjoy watching this Story develop!

Share

Content

Introduction

What is Story Protocol (IP)?

Why Story Protocol Could Soar in 2025

$IP’s Rollercoaster Price History

Short-Term Price Predictions (2025–2026)

Long-Term Outlook (2027–2028 and Beyond)

Conclusion

Story Protocol (IP): Bullish Growth Potential in the 2025 Web3 Surge

Introduction

What is Story Protocol (IP)?

Why Story Protocol Could Soar in 2025

$IP’s Rollercoaster Price History

Short-Term Price Predictions (2025–2026)

Long-Term Outlook (2027–2028 and Beyond)

Conclusion

Introduction

The 2025 crypto bull run has ignited excitement around Story Protocol ($IP), a new Web3 project aiming to revolutionize intellectual property rights on the blockchain. Story Protocol’s layer-1 network for programmable IP is gaining traction as creators and developers seek better ways to monetize content in an AI-driven era. Backed by top venture capital (like a16z) and fresh off a successful mainnet launch, $IP has quickly entered the top 100 crypto ranks by market cap. With the broader market rallying and narratives like AI and Web3 convergence in full swing, many see Story Protocol as a high-upside contender in 2025. Let’s dive into what Story Protocol is, why the outlook is so bullish, and what price trends and predictions suggest for the short and long term.

What is Story Protocol (IP)?

Story Protocol is a purpose-built blockchain for intellectual property (IP) management in the Web3 era. Think of it as the infrastructure for owning, licensing, and monetizing creative content on-chain. Built as its own layer-1 (combining Ethereum Virtual Machine compatibility with Cosmos SDK performance), Story Protocol lets creators tokenize any form of IP – whether it’s an idea, image, song, or even AI-generated content – as a unique NFT-based asset called an “IP Asset.” Each IP Asset is tied to a token-bound account (using the ERC-6551 standard), which stores programmable rules for how that IP can be used or remixed. This means licensing agreements, royalty splits, and usage permissions are all automated by smart contracts. For example, an artist can register a digital artwork on Story and set it so that if someone uses it in a game or AI training, the smart contract automatically enforces a royalty fee back to the artist.

In short, Story Protocol provides the Web3 IP infrastructure creators have been waiting for: a transparent, decentralized system to protect creative rights while encouraging collaboration. In an age where generative AI can remix content in seconds and traditional copyright laws fall behind, Story offers a new solution. By moving IP rights on-chain, it enables “programmable IP” – making it easy to prove ownership, trace derivatives, and ensure original creators get paid. This positions Story Protocol at the heart of a $60+ trillion global IP market poised for disruption.

Why Story Protocol Could Soar in 2025

Multiple factors are fueling a bullish outlook for $IP in this bull market:

Innovative Tech & First-Mover Advantage

Story Protocol is pioneering a novel concept – an “IP blockchain”. Its use of token-bound accounts (ERC-6551) and Programmable IP Licenses (PIL) is a game-changer for the creative economy. This level of on-chain IP programmability hasn’t been seen before, giving Story a first-mover advantage in a huge untapped niche. As AI-generated art, music, and content explode, Story’s solution for tracking and monetizing those creations gives it strong narrative momentum (AI + blockchain + creator economy is a powerful combo). Projects with unique narratives tend to perform exceptionally well in bull runs, and Story fits the bill.

Strong Token Utility and Tokenomics

The $IP token isn’t just a governance coin – it’s the lifeblood of the Story ecosystem. $IP is used for transaction fees (e.g. registering IP, executing licenses), staked by validators to secure the network (Proof-of-Stake), and used in governance votes for protocol upgrades. Importantly, creators may also use $IP within the platform to set licensing terms or stake for higher visibility, adding to its demand. The tokenomics are designed for sustainable growth: out of a 1 billion total supply, only 25% was unlocked at launch (with ~280M $IP circulating in mid-2025). The rest is allocated to support long-term development – with 38.4% for ecosystem & community growth, 10% for user incentives, 10% to the foundation, 21.6% to early backers (locked over 4 years), and 20% to core contributors. This balanced distribution (see chart below) means the team and investors are vested long-term, while a large chunk is reserved to attract developers and users. As adoption increases, $IP’s built-in utility could translate into rising demand, all while supply release is gradual and planned.

$IP Token Allocation – a balanced distribution focusing on ecosystem growth (largest share), with long-term vesting for team and backers. Token utility (fees, staking, governance) drives organic demand.

Developer Traction & Ecosystem Growth

Story Protocol has been rapidly attracting developers and partners to build out its ecosystem. Even before the public mainnet, it launched on testnets and collaborated with Web3 builders. For instance, Story partnered with the AI startup Ritual to help AI developers register and track their generative models’ outputs on-chain – a proof of concept that Story can serve emerging AI dApps. It’s also integrated with tools like MyShell (a platform for building AI chatbots), allowing creators there to secure their AI models as IP Assets on Story. On the creative side, Story teamed up with art platform Magma to empower digital artists with on-chain IP licensing. These early collaborations signal real developer interest in Story’s protocol. The network is EVM-compatible and cross-chain friendly (thanks to Cosmos tech), making it easy for Solidity devs and others to join. As more devs experiment with IP-based dApps – from NFT remix marketplaces to AI content platforms – Story’s ecosystem could snowball, drawing in even more users and boosting $IP usage.

Major Backing and Partnerships

Confidence in Story Protocol runs high among industry leaders. The project has raised over $130 million in funding, including a $29M seed and $25M Series A in 2023 led by Andreessen Horowitz (a16z), followed by a whopping $80M Series B in August 2024 (again led by a16z). Such backing from a top-tier crypto VC not only provides capital for development but also validates Story’s vision. Even celebrities and media figures have taken note – Paris Hilton’s 11:11 Media fund invested early, seeing potential in Web3 IP. On the partnership front, Story isn’t just sticking to crypto circles; it’s collaborating with academia and AI research heavyweights. In early 2025, Story Protocol announced a partnership with Oxford University to advance “Agent TCP/IP,” an initiative exploring how AI agents can autonomously negotiate and trade IP assets on-chain. The idea of AI bots buying/selling licensed data using Story’s protocol is futuristic – and exactly the kind of bold innovation that grabs headlines. Together, these investments and partnerships give Story both credibility and access: credibility in that experts believe in it, and access to networks of creators, developers, and even researchers who can amplify its adoption.

Roadmap Execution & Upcoming Catalysts

Story Protocol’s team has delivered on key milestones and has an ambitious roadmap for 2025 and beyond. Mainnet launched in Q1 2025 (on February 13, 2025 to be exact), complete with an airdrop to early community members, which put $IP in circulation and kickstarted the network. In Q2 2025, the team rolled out the IP Portal (public beta) – a user-friendly hub where anyone can seamlessly register their IP assets and browse content registered across various apps on Story. Alongside, a Story Attestation Service debuted in beta, bringing a decentralized oracle network to verify on-chain IP data (like checking creator identities or detecting plagiarism). Looking ahead to late 2025, the project plans a major network upgrade focusing on performance (higher throughput, faster transactions) and further decentralization (adding more community-run validator nodes). These continual improvements show a commitment to scalability and security as usage grows. Beyond tech upgrades, more real-world use cases are likely on the horizon – think brands protecting their content, game developers trading IP, or streaming platforms integrating Story for rights management. Each new integration or feature can act as a catalyst for $IP demand. The bottom line: Story Protocol is not vaporware; it’s shipping product and expanding, which bodes very well in a bull market where execution is rewarded.

$IP’s Rollercoaster Price History

Like many hyped new tokens, $IP has seen wild price swings in its early life. The coin launched on exchanges in mid-February 2025 around the time of mainnet launch, initially priced near $1.00 (with many tokens claimed via airdrop by early users). Within days, intense buying pressure drove $IP up over $7, marking an all-time high by late February. This ~600% surge in a week made headlines and put Story Protocol on the map as one of the top-performing new crypto assets of the year. What fueled the spike? The combination of bull market optimism, low initial circulating supply, and excitement over Story’s roadmap likely all played a role. News of the upcoming IP Portal and oracle service in Q2 2025 also added to the FOMO.

However, early rallies often face corrections. After peaking above $7.3, $IP experienced a pullback as traders took profits. Over the next couple of months, the price retraced and stabilized in the $4 range. By mid-2025, $IP hovers around ~$4. This is still well above its launch price, reflecting that bullish momentum held strong despite volatility. Essentially, $IP had a classic “pump and settle” debut: initial euphoria, then finding a baseline once the market cooled slightly. The token’s market capitalization currently sits around $1.1 billion, placing Story Protocol firmly in the top 70–80 projects – an impressive feat for a project barely a few months into mainnet.

IP Token Price History – from a $1 launch to a $7+ surge and a healthy consolidation around $4 by mid-2025. The initial spike highlights the excitement around Story Protocol’s launch and roadmap, followed by a natural retracement as the market found equilibrium.

This rollercoaster price history shows that $IP can rally hard when momentum is behind it. It’s also a reminder that new tokens are volatile; early investors have already seen huge gains and steep dips. Yet, the fact that $IP has maintained levels several times its initial price indicates real conviction in the project. Now, with the token’s early price discovery phase behind it, traders and analysts are looking ahead to where $IP might go next in this bull cycle.

Short-Term Price Predictions (2025–2026)

With Story Protocol back in the spotlight and the 2025 bull run accelerating, what do analysts think $IP could be worth in the next year or two? Price predictions are always educated guesses (and not financial advice!), but the short-term sentiment for $IP is optimistic if current trends continue. Let’s break down some forecasts for 2025 and 2026, along with the reasoning behind them:

2025 Price Targets

Many forecasters see Story Protocol climbing further by late 2025 as its platform gains users. Conservative estimates for end of 2025 put $IP in the $5–$8 range. These assume steady growth of the Story ecosystem (more IP assets, a few high-profile partnerships) without any explosive viral adoption. On the more bullish side, some crypto enthusiasts on forums speculate that if the 2025 bull market is truly massive, $IP could potentially reach double-digits, perhaps testing the $10–$12 zone by year-end. This optimistic scenario would likely require Story Protocol to exceed expectations – for example, a surge in on-chain IP registrations or a major company announcing they’ll use Story for content licensing. A mid-ground prediction from one crypto research outlet suggests ~$7–$9 as a reasonable target by Q4 2025, which assumes the overall market stays hot and Story continues delivering news and improvements.

Justification (2025)

The reasoning for $IP’s growth this year centers on increased usage and bull market conditions. In a broad crypto bull run, capital tends to flow into strong narrative coins – and Story hits multiple hot narratives (Web3 infrastructure, AI, NFTs). If Bitcoin’s post-halving rally lifts all altcoins (as history often shows), $IP stands to benefit. Specifically, look at user adoption: by end of 2025, Story’s IP Portal and partnerships could bring thousands of creators and developers onto the network. Each new participant potentially means more demand for $IP (for fees, staking, etc.). Additionally, the supply dynamics are favorable in the near term; with a quarter of supply circulating and major investors likely holding long-term, sell pressure is somewhat limited while new buyers enter. Technically, if $IP can break above its post-launch trading range (clearing resistance around $5–$6), that could trigger the next leg up as momentum traders pile in. Overall, as long as the crypto market remains upbeat through 2025 and Story shows tangible growth, the short-term bias for $IP is bullish. Volatility will persist, but dips might be seen as buying opportunities by those who believe the project’s best days lie ahead.

2026 Outlook

Looking into 2026, most predictions continue the bullish trajectory but at a more measured pace (especially if 2025 ends with a blow-off top rally). Various crypto price models project $IP in the $8–$15 range during 2026. A moderate scenario could be $IP averaging around $10–$12 in 2026 – essentially holding onto its 2025 gains and perhaps growing a bit more as the platform matures. More optimistic forecasters – assuming Story Protocol really catches fire by then – float the idea of $IP reaching high teens (say $15–$18) by the end of 2026. This would likely require that Story becomes a widely used backbone for IP transactions across multiple industries (not just crypto art, but maybe music rights, gaming IP, etc.). There are even whispers of $IP possibly doubling its 2025 highs if the Web3 creator economy booms – that means targets above $14, which, while aggressive, aren’t impossible in a euphoric market. On the cautious side, some algorithmic predictions show a plateau or slight dip in 2026, especially if 2025’s bull run was huge (the idea being that 2026 could see a cooling-off or mini-bear). Even those conservative models, however, tend to keep $IP well above today’s price (often still in mid-single digits at worst).

Justification (2026)

By 2026, the hype cycle will need backing by real usage metrics. The optimistic case is that by then, Story Protocol will have a thriving ecosystem: perhaps dozens of dApps, tens of thousands of IP assets registered, and maybe some revenue-generating use cases (like popular NFT marketplaces or AI content platforms paying royalties via Story). This kind of traction would firmly establish a valuation floor for $IP due to fundamental demand. Also, 2026 might be a year where crypto as a whole either consolidates or enters a mid-cycle; if it’s the former, investors will be picky – and a project with actual adoption like Story could stand out and retain value. Watch for how token unlocks are handled too: early backer tokens will still be vesting through 2026, but if they remain committed or tokens get redeployed into the ecosystem, the impact could be minimal. Any technical breakthroughs or big partnerships announced in 2026 (say, integration with a major media franchise or a government using Story for digital IP registries) would of course be wildly bullish catalysts. All in all, the 2026 outlook for $IP largely depends on execution – but current signs (funding, roadmap progress, community growth) give reason to believe Story Protocol will keep the wind at its back moving into 2026.

Projected $IP Price Trend (Short-Term) – An illustrative scenario of $IP rising from roughly $4 in mid-2025 to the $10+ range by the end of 2026. This assumes continued bull market momentum and growing adoption of Story Protocol’s platform through the next year or two.

Long-Term Outlook (2027–2028 and Beyond)

Thinking further ahead, what might Story Protocol be worth in a few years if it truly fulfills its vision? Predicting crypto prices out to 2028 is certainly speculative, but it’s a useful thought exercise to consider $IP’s long-term potential. If Story Protocol becomes foundational to Web3’s creator economy, the upside could be significant. Here are some long-term price musings and the factors that could drive $IP by 2027–2028:

2027 Expectations

By 2027, Story Protocol will either have proven its utility as critical Web3 infrastructure or faded away – and at this point, sentiment leans toward success. A number of long-range forecasts see $IP continuing an upward trajectory into 2027. For example, one optimistic analysis puts $IP in the $15–$25 range in 2027, meaning it would handily surpass its previous highs as the project matures. Even more conservative predictions land in the low double-digits for 2027 (say $10–$15). The general idea is that if Story Protocol thrives over the next few years, by 2027 it could be a much larger ecosystem with mainstream recognition, thus commanding a higher token price. It’s also worth noting that 2027 could align with another major crypto market cycle peak (following the typical four-year cycle after 2025’s bull run). If so, that macro tailwind could amplify prices across the board – including $IP. In a peak cycle scenario, seeing $IP push past $20 in 2027 isn’t off the table.

2028 and Beyond (The Moonshot Scenario):

Looking at 2028 and onwards, some analysts aren’t shy about setting bold targets for Story Protocol if all goes exceedingly well. There are projections of $IP reaching $30+ by 2028, with a few extreme bullish cases even hinting at the $40–$50 range longer-term. Why such big numbers? If by 2028 Story Protocol truly becomes the global standard for registering and trading IP rights – imagine major studios registering film IPs on-chain, global artist communities using Story for licensing, or AI companies relying on Story for dataset provenance – then $IP would have massive real-world utility and demand. In that scenario, Story could be a top-tier crypto project by market cap, possibly in the same conversation as today’s leading smart contract platforms. For context, a price of ~$30 would imply a market value in the tens of billions (given the supply), which, while ambitious, might be justified if Story underpins a significant portion of the digital content economy. On the more cautious side, not everyone foresees a moonshot. Some long-term models project a more modest $10–$20 range for 2028 if growth is steady but not explosive, factoring in competition and the natural saturation of the market. These models assume that while Story will grow, it might share the space with other IP or content-focused protocols by then, which could cap its upside. Still, even those tempered predictions put $IP above current prices, reflecting a generally positive long-term outlook.

Justification (Long-Term):

The long-term trajectory for $IP boils down to adoption and integration. By 2027–2028, if Story Protocol is widely adopted, it could benefit from network effects – more creators registering IP begets more content for others to remix and license, which attracts more developers to build on the platform, and so on. A virtuous cycle of growth would cement Story’s position and drive continual token demand. Additionally, external factors could boost Story’s prominence: For instance, if regulators or courts start recognizing on-chain IP records as valid (or if new copyright frameworks emerge for AI-generated work), Story’s early mover advantage could make it the go-to solution. Another factor is competition – while Story is first, it’s likely not the last in blockchain IP. If it manages to outpace or absorb potential rivals by 2028, that would greatly strengthen its market share and token value. Conversely, strong competition could limit $IP’s market capture, one reason some forecasts stay moderate. Technologically, the protocol will need to scale efficiently by 2028 (handling potentially millions of IP assets and transactions), but given the team’s focus and funds, there’s confidence here. Essentially, the moonshot scenario for $IP in 2028 requires that Story Protocol becomes as important to digital content as something like Ethereum is to DeFi today – a backbone infrastructure. It’s a tall order, but it’s also the kind of ambitious vision that crypto bull markets love to bet on.

Illustrative Bullish Outlook for $IP (2025–2028) – In a potential optimistic scenario, $IP could climb into the $20+ zone by 2028, riding on widespread adoption and the growth of on-chain IP markets. While this is speculative, it highlights the significant upside bulls are eyeing over the long run.

Conclusion

Story Protocol’s journey is just beginning, but it’s already shaping up to be one of the most intriguing projects in Web3. By tackling a massive real-world problem (IP rights in the digital age) with cutting-edge blockchain tech, Story has put itself at the crossroads of major trends: the boom in AI-generated content, the rise of NFTs and digital collectibles, and the push for decentralization in creative industries. The current crypto bull run has shone a spotlight on $IP, and much of the sentiment is bullish – with good reason. Story Protocol blends a visionary idea (a global registry and marketplace for creativity) with concrete progress (mainnet live, active partnerships, strong token utility). Its price history shows it can capture market imagination and rally hard, and recent developments suggest the project has real momentum heading into late 2025.

Is $IP guaranteed to be the next big thing? Of course not – nothing in crypto (or life) is guaranteed. There are risks: technological hurdles, user adoption uncertainty, and competition can all influence outcomes. But the bullish caseenvisions Story Protocol becoming a foundational piece of the creator economy’s future infrastructure. If that happens, the value of $IP could be far higher than it is today. In the short term, traders are watching key levels (can $IP reclaim $7+ and turn it into support? Will it break into double-digits with enough hype?). And in the long term, believers are dreaming of much larger milestones – potentially $20, $30, or beyond by 2028 – if Story truly conquers the Web3 IP space.

For now, it’s safe to say Story Protocol has graduated from launch-phase obscurity to a strong contender on investors’ radars in 2025. It’s bold, unproven, but full of promise – exactly the kind of project that crypto bull markets are known to elevate. Whether you’re excited by its mission to empower creators or you’re simply on the hunt for the next high-upside altcoin, $IP is a token worth watching as this bull run unfolds. As always, remember to do your own research and consider your risk tolerance – the crypto arena is volatile, and even the brightest stories can have twists and turns. But with innovation alive and well in projects like Story Protocol, the 2025 market surge is writing an exciting new chapter for Web3. Happy investing, and enjoy watching this Story develop!