The story behind xStocks: Rome was not built in a day

The public saw xStocks launch in the first half of 2025, but behind the scenes, the team spent at least four years preparing. This article revisits their experience from financial and compliance perspectives, with the goal of developing a practical financial compliance framework for similar future projects.

I. The Story of Tax Planning and Compliance in Company Registration

The founding team identified major trends and opportunities in stablecoins and real-world assets (RWAs) as early as 2021, aiming to build a bridge between traditional equity and blockchain. With this vision set, their next step was implementation.

Naturally, the first step was to incorporate a company.

The choice of jurisdiction is key. The team behind xStocks first chose Switzerland.

Why Switzerland? Much like Silicon Valley in the U.S., Zug, Switzerland, has earned the nickname “Crypto Valley”—it’s where the famous Ethereum Foundation was established. Switzerland has long been a global financial center, open to blockchain innovation and a front-runner in regulatory and legislative frameworks. As early as 2021, Switzerland expanded its securities laws to cover DLT (Distributed Ledger Technology), with parts of the new legislation effective February 1, 2021, and the full law in force by August 1, 2021.

The company registration of the issuer closely tracked the rollout of these laws.

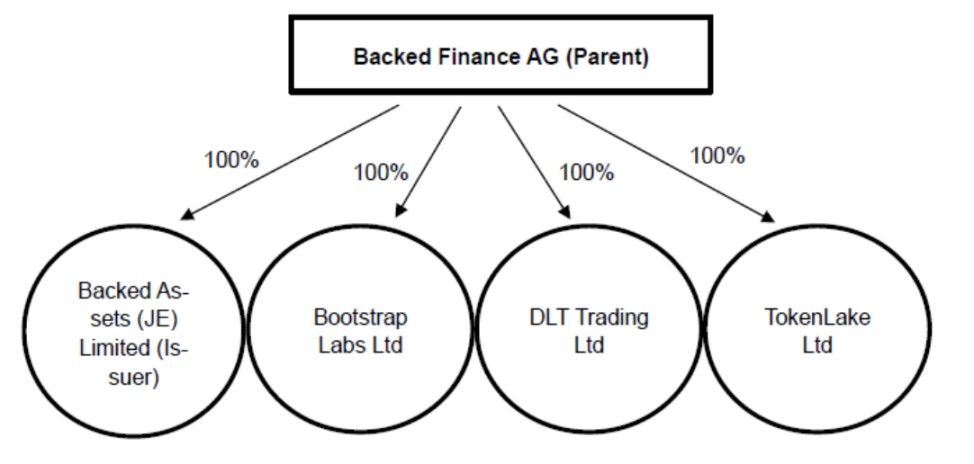

Three main entities are involved in the xStocks business:

- Backed Finance AG, the issuer’s parent company, registered in Zug and founded in early 2021. Switzerland’s DLT law partially took effect on February 1, 2021. These dates are hardly coincidental—the founders are highly professional, sharp, and decisive.

- Backed Assets (JE) Limited, a private company incorporated in Jersey on January 19, 2024, is the xStocks issuer.

- Backed Assets GmbH, incorporated in Switzerland on April 20, 2021, merged with the issuer on February 23, 2024. Backed Assets (JE) Limited became the surviving entity, assuming all assets and liabilities of Backed Assets GmbH.

Why set up Backed Assets (JE) Limited? Why not have the parent—Backed Finance AG—act as issuer directly?

It’s about separating functions. By delegating issuance to a dedicated subsidiary, Backed Finance AG can focus on its core tokenization technology and services, while the issuer is focused exclusively on product issuance. This is a widely adopted corporate governance and risk management strategy.

But why not incorporate in Switzerland and instead set up in Jersey? What makes Jersey attractive?

Jersey is an island between the UK and France (about 5 miles long by 9 miles wide/8 km by 14.5 km) with its own independent legal system, courts, and government—recognized as a separate jurisdiction globally. (Source: Government of Jersey)

The team’s primary consideration was tax. The issuer’s revenue comes mainly from up to a 5% fee on product issuance and redemption. As the business scales, these revenues can become substantial—making tax structuring critical from the outset. The best scenario: zero corporate taxes. The team explored their options and ultimately selected Jersey after reviewing the Jersey Income Tax Law, which provides for three corporate tax rates:

- 0%: Default rate

- 10%: Financial services companies

- 20%: Utilities, cannabis, income from land, and profits from hydrocarbon oil import/supply.

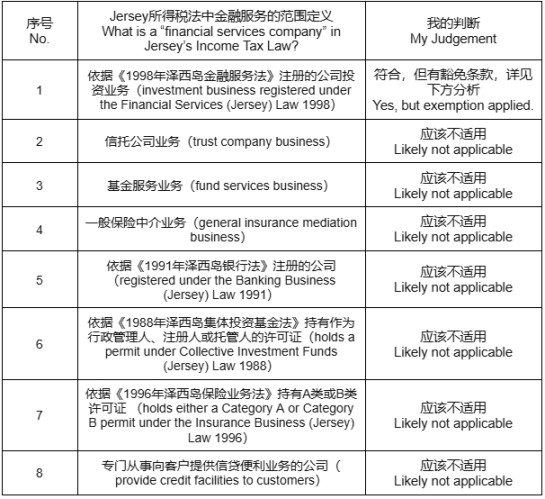

The question: Could this business fall under financial services—and could the structure qualify for the 0% rate? The table below (from the law, with commentary) outlines the definitions relevant to financial services companies and the likely interpretation by the founders.

In-depth analysis: To avoid the 10% tax as a financial services company, the team conducted deep legal research—this was core to the business architecture. This can be broken down as follows.

The Financial Services (Jersey) Law 1998 defines “investment business” as:

- Dealing in investments: buying, selling, subscribing, or underwriting investments as principal or agent.

- Arranging deals: arranging (for self or others) to buy, sell, subscribe, underwrite, or convert investments.

Given that the issuer’s main business model involves transaction fees on these buy/sell activities, at first glance it meets the “investment business” definition, calling for the 10% rate.

But the team found another law: the Financial Services (Investment Business (Special Purpose Investment Business – Exemption)) (Jersey) Order 2001. Article 4(1) offers exemptions for certain Special Purpose Vehicles (SPVs)—allowing qualifying entities to avoid the “financial services company” classification and thus the 10% tax rate under Jersey law.

Exemption criteria include:

- Having special purpose company status with appropriate approval

- Sole or primary business is:

- Granting loans, providing guarantees, or engaging in derivatives

- Issuing securities

- Securitization, acquisition, or asset repackaging

- Capital markets transactions

- Other transactions approved by the authorities or related to above

Seeing these conditions, the team strategized how to qualify for exemption. The natural answer: set up a Jersey company whose only business is the issuance of securities. Even if not automatically covered, they could apply for special approval. Thus, the road map was set: establish an SPV in Jersey for the issuer.

That’s why, after Backed Assets (JE) Limited was established on January 19, 2024, Backed Assets GmbH was merged into the issuer just a month later, on February 23, 2024—demonstrating rapid execution. This SPV structure also achieves the previously mentioned function separation for governance and risk management.

Another key reason for choosing Jersey is licensing. Typically, securities issuance requires a license. In Jersey—a self-governing jurisdiction—issuance doesn’t require a full license, just local government approval. That’s much more straightforward. While Switzerland can offer licenses, their entry requirements—plus the added tax benefits—made Jersey the clear winner.

Key takeaway for future teams: Tax law reflects a country’s sovereignty and policy aims. The main statutes usually outline the full tax scope. If you don’t see breaks in the headline law, dig into supporting laws and special provisions—opportunities often lie there. Look for explicit incentives or special approval channels; sometimes governments deliberately leave the door open for flexibility.

II. Compliance Story of Asset Custody

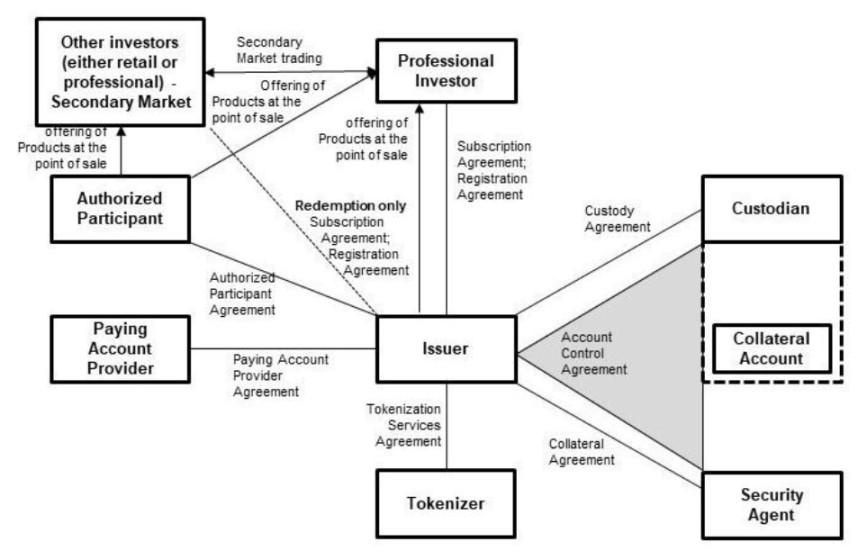

Source: Company’s Securities Notes

The xStocks product model is simple: Investors send funds to the issuer, the issuer buys the actual underlying stocks, and credits the investor’s wallet with the corresponding xToken value. To prevent misuse or loss of those real-stock assets, the safest approach is to entrust them to a credible third party: a custodian.

Custody is crucial for asset safety—and also plays a vital role in anti-money laundering (AML), know-your-customer (KYC), and compliance. This is why countries have specific rules—like the U.S. Investment Advisers Act of 1940 and the UK’s CASS Rules.

xStocks’ product page lists three different custodians. Why?

The reasons for using multiple custodians include:

- Risk diversification—if one custodian has an issue (asset loss, system outage), others preserve security.

- Regulatory compliance—xStocks is a global product, excluding the U.S.; different jurisdictions have different regulatory frameworks.

- Operational flexibility and efficiency—some custodians specialize in certain assets (stocks, ETFs) or have better blockchain integration (like Solana or Ethereum). Multiple custodians enable optimized asset management and settlements.

- Scalability—multiple custodians can handle increased business volume and support future asset expansion (bonds, other RWAs, etc.).

The three custodians are:

- Alpaca Securities LLC (Wilmington, North Carolina, USA): An SEC-registered broker-dealer and FINRA member. Securities account control agreement dated June 20/23, 2025, under New York law.

- Maerki Baumann & Co. AG (Zurich, Switzerland): FINMA-licensed Swiss bank serving as Swiss custodian. Custody agreement dated November 23/24, 2022, under Swiss law.

- InCore Bank AG (Zurich, Switzerland): Securities trading outsourced from Maerki Baumann & Co. AG.

- Alpaca Crypto LLC (San Mateo, California, USA): FinCEN-registered money services business acting as U.S. crypto custodian. Cryptocurrency services agreement dated March 28, 2025, under California law.

But if business can’t be conducted in the U.S., why use U.S. custodians?

This is tied to the team’s innovation: an alternative collateral structure. In short, the issuer designed a new model for holding and managing collateral to make xStocks more scalable and further mitigate settlement risk.

Since many underlying assets (like U.S. equities) trade on U.S. markets, using U.S.-based custodians and brokers enables direct, efficient purchase, custody, and sale—streamlining settlement and reducing the complexity and delays of cross-border transactions. This approach is analogous to traditional warehousing: storing assets at the origin enables faster, more efficient logistics, regardless of where the end customer is located.

Key takeaway for future teams: Custody is essential. Depending on where the underlying assets are, engage multiple custodians as needed.

III. From Professional Investors to Retail Investors

Under Jersey law, products can only be issued to two groups:

- Professional Investors—individuals whose day-to-day business involves acquiring, holding, managing, or disposing of investments (as principal or agent).

- Individuals who have received and acknowledged the “SPB Order Investment Warning,” which states that the product is suitable only for those with significant assets and the financial sophistication to understand risks, and that the product and all related activities are not fully regulated under the Financial Services (Jersey) Law 1998. Investors must confirm they fit one of these categories prior to issuance.

In effect, only professionals and financially capable, risk-tolerant investors can participate. Issuing to others violates Jersey’s regulatory approval—risking loss of the 0% tax rate or the ability to operate at all.

So how can retail investors access xStocks?

The key is exploiting market structure, blockchain openness, and Backed Finance’s partnerships with exchanges and DeFi platforms.

For exchanges, the point is simple: as long as retail investors don’t participate in the initial issuance, compliance is maintained. The exchanges collaborating with the issuer are regulated and follow strict KYC processes. xStocks is initially issued only to the two approved investor types; once on-chain, it becomes freely tradable by retail participants—beyond Jersey’s regulatory reach.

Retail access could also come via DeFi platforms, or professional investors could repackage xStocks into new products for distribution to retail investors after the initial issuance.

Key takeaway for retail investors: Bypassing initial offering restrictions shifts risk to retail buyers. Be aware of your informational limitations—always read the prospectus risk disclosure before investing and ensure you fully understand what you’re buying.

IV. The Team

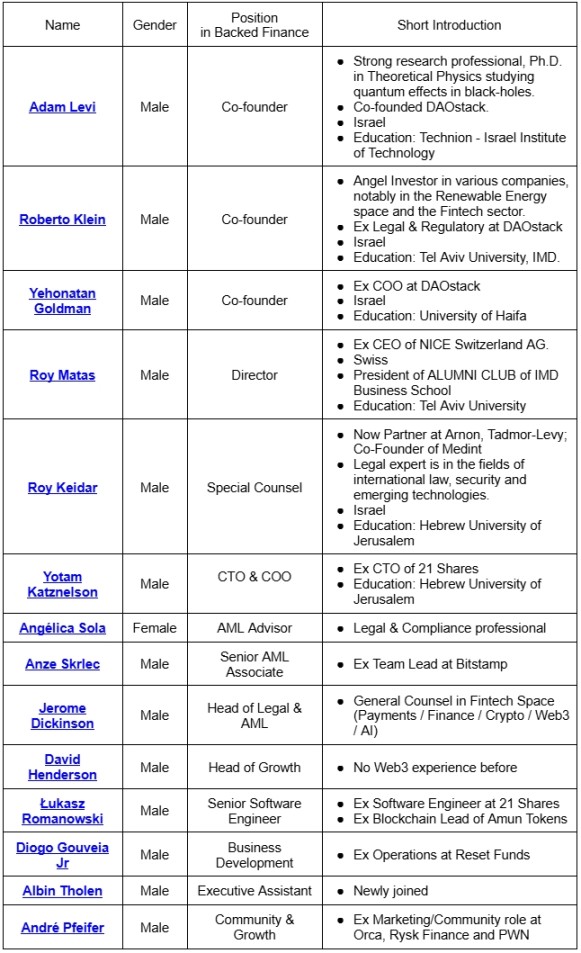

According to the table above:

- The core team is from Israel and likely has a Jewish background.

- The founders possess significant experience and share similar backgrounds and philosophies—many are alumni or former colleagues.

- They place strong emphasis on compliance. In addition to legal specialists, there are three professionals dedicated to AML.

Conclusion:

Over the four-plus years since 2021, the journey from initial concept to launch for an innovative financial product has proven far more challenging than outsiders might imagine. The three stories above provide only a partial view, but demonstrate that success depends on timing (the tokenization megatrend), location (the right jurisdiction), and people (talent and ecosystem partners) coming together.

Disclaimer:

- This article is reprinted from [TechFlow], with copyright belonging to the original author [Finance Web3]. For concerns about reprinting, please contact the Gate Learn Team. We will address your request promptly according to our established process.

- Disclaimer: The opinions and views expressed here are solely those of the author and do not constitute investment advice of any kind.

- Other language versions of this article are translated by the Gate Learn team. Without explicit reference to Gate.com, the translated content may not be reproduced, distributed, or plagiarized.