Visit our ComplexityTrading website for an introduction to the ideas discussed in our show.

More

BTC_POWER_LA

No content yet

BTC_POWER_LA

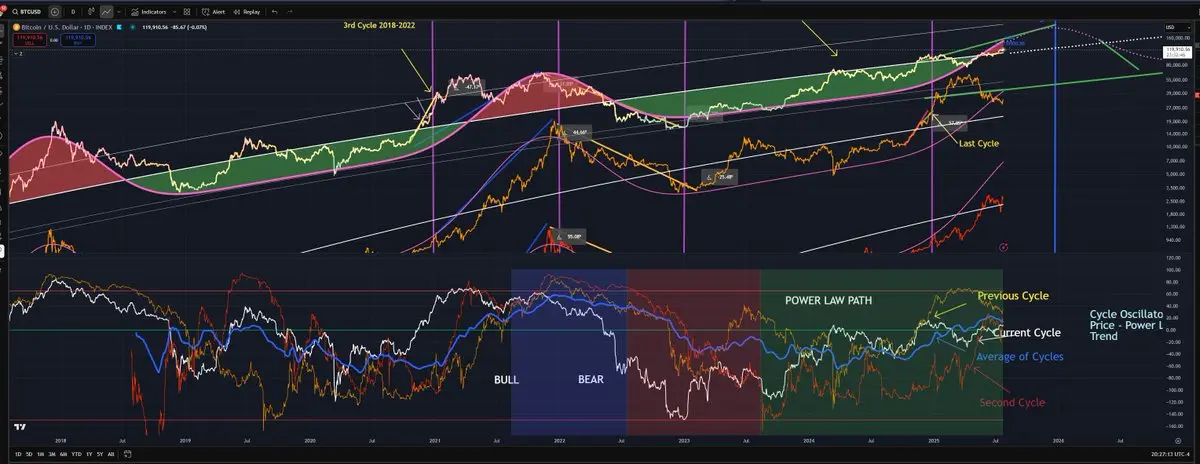

Cycle comparison.

Each subsequent line represents 4 years in the past.

The lower panel shows normalized deviations from the power law.

Every cycle has its own personality. For this cycle, we've seen aggressive moves around the ETF launch period that appear to have disrupted the usual run-up typically observed in November during the two years spent in the core power law zone (green area).

It remains unclear whether we'll experience a proper cycle with a distinct top, characterized by large deviations from the power law.

So far, it's been difficult for the price to deviate significantly from

Each subsequent line represents 4 years in the past.

The lower panel shows normalized deviations from the power law.

Every cycle has its own personality. For this cycle, we've seen aggressive moves around the ETF launch period that appear to have disrupted the usual run-up typically observed in November during the two years spent in the core power law zone (green area).

It remains unclear whether we'll experience a proper cycle with a distinct top, characterized by large deviations from the power law.

So far, it's been difficult for the price to deviate significantly from

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

At 3:00 PM PST we will have a new show of the "Bitcoin Critical Pulse" with Giovanni and Chris.

We are discussing the latest price action using indicators and methods based on critical phenomena science.

These are powerful tool to tell us how the state of the system changes from order to disorder.

Join us here on X, Twitch and YouTube.

We are discussing the latest price action using indicators and methods based on critical phenomena science.

These are powerful tool to tell us how the state of the system changes from order to disorder.

Join us here on X, Twitch and YouTube.

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

Whoever bought this drawing from Donald should get their money back given he never drew a pic in his life, so evidently this is fake.

GET-0.63%

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

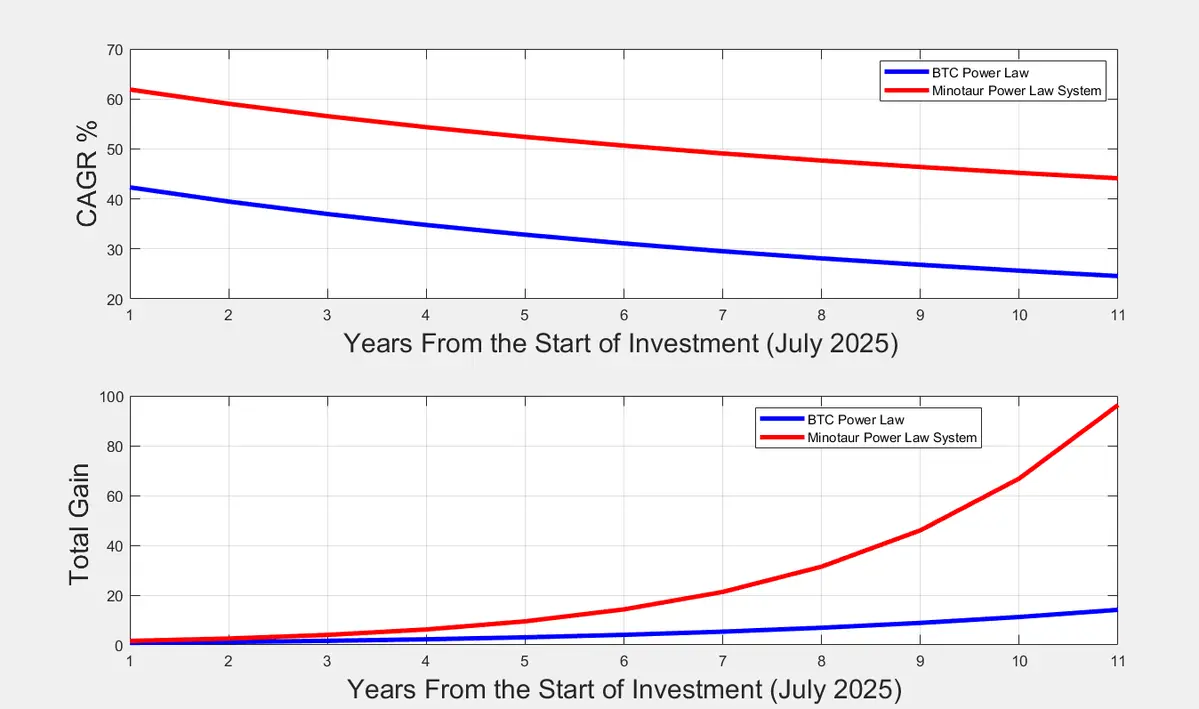

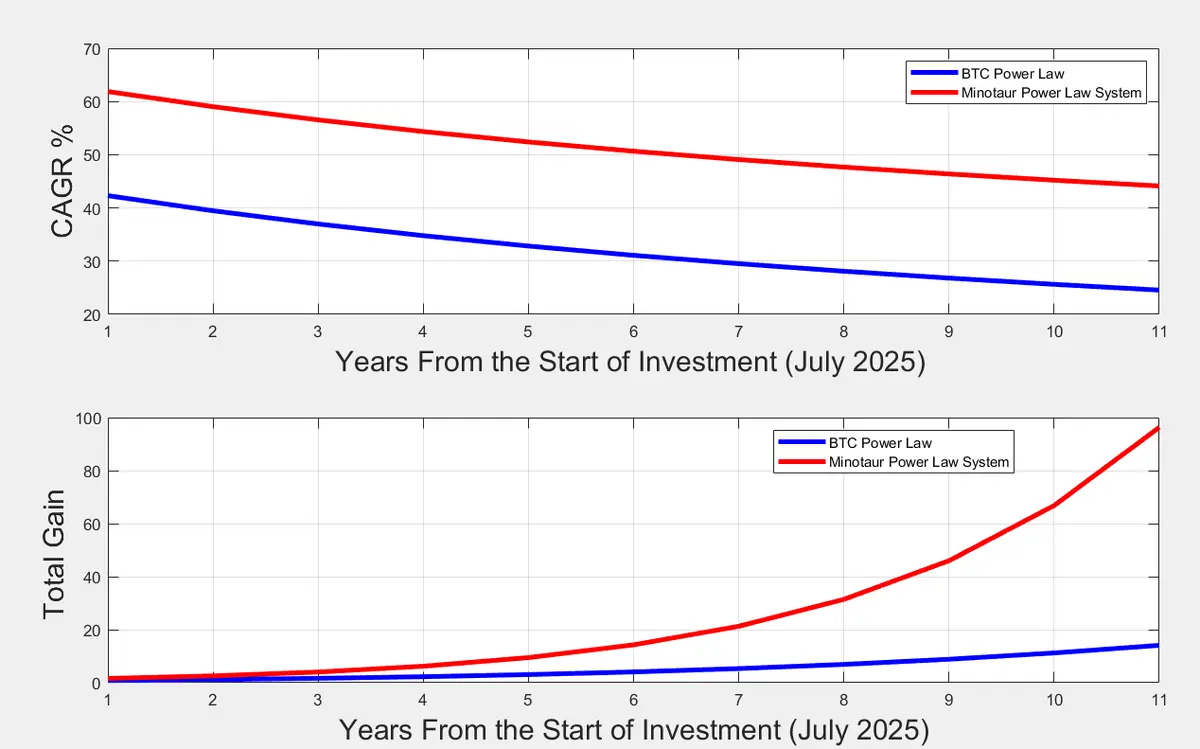

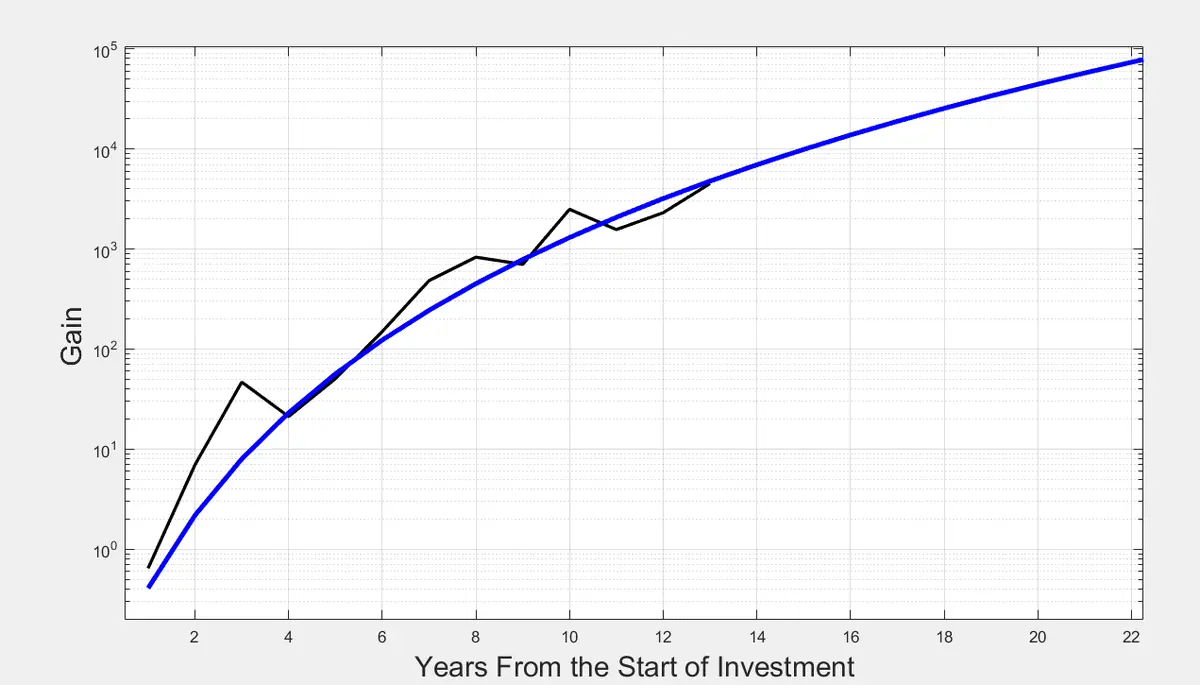

Reposting this graph. It is quite crazy.

Even a small yield on Bitcoin (if re-used to stack more BTC), it can bring back the type of returns we were used to several years ago (need to check what it would be equivalent to in terms of years back).

Even a small yield of 1.5 % a month could make the difference between 15x in 11 years and 100x.

We have a trading system that uses Bitcoin as a collateral that does much better than this but I used this value as a conservative example.

DM me if you want to learn more about the Power Law Minotaur Trading system.

Even a small yield on Bitcoin (if re-used to stack more BTC), it can bring back the type of returns we were used to several years ago (need to check what it would be equivalent to in terms of years back).

Even a small yield of 1.5 % a month could make the difference between 15x in 11 years and 100x.

We have a trading system that uses Bitcoin as a collateral that does much better than this but I used this value as a conservative example.

DM me if you want to learn more about the Power Law Minotaur Trading system.

- Reward

- like

- Comment

- Share

Same chart as before but in log-linear space.

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

Why I insist so much in having a way to multiply your Bitcoins as silly this term seems?

What if you did 1.5 % a month relative to Bitcoin (our system does much better than that but let's be conservative)?

How much would your gain would be in 11 years?

Almost 100x or about 7x your initial Bitcoin.

What if you did 1.5 % a month relative to Bitcoin (our system does much better than that but let's be conservative)?

How much would your gain would be in 11 years?

Almost 100x or about 7x your initial Bitcoin.

- Reward

- like

- Comment

- Share

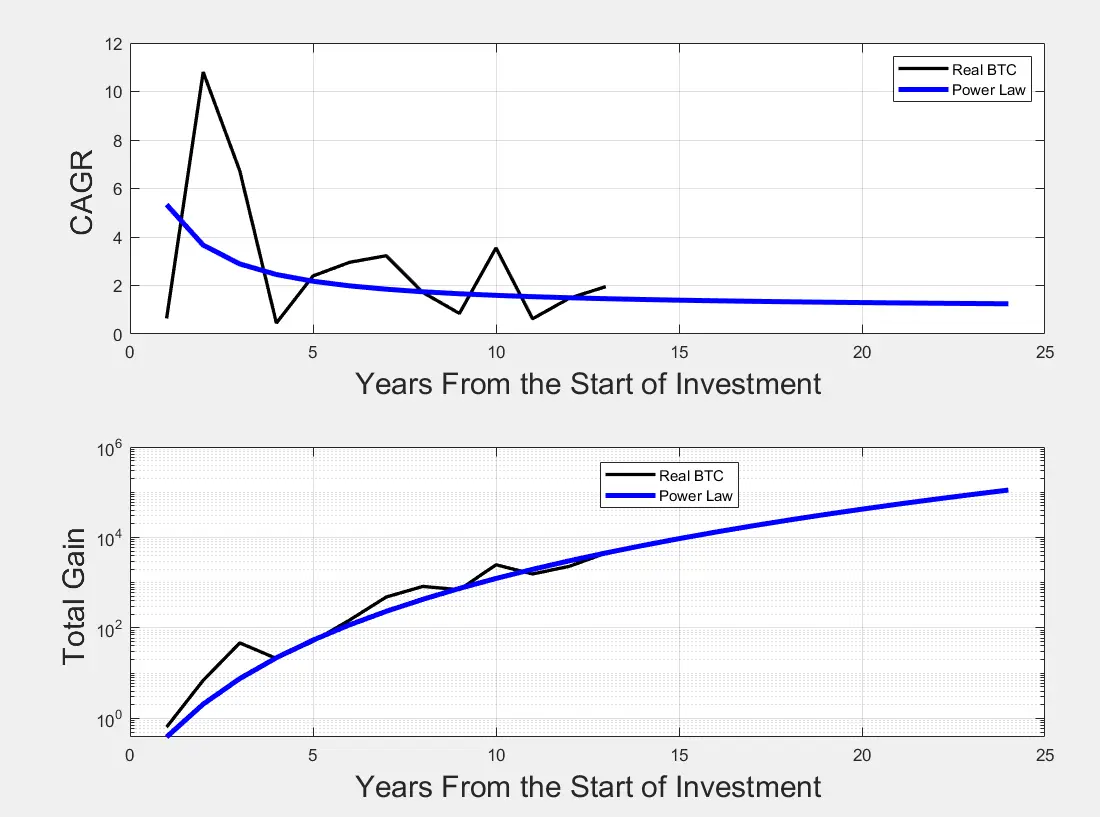

Here I focus on the projections of CAGR and Total Gains for the next 11 years.

The CAGR is in % so it is easier to read.

The gains are multiplier 2 means 2x and so on.

The CAGR is in % so it is easier to read.

The gains are multiplier 2 means 2x and so on.

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

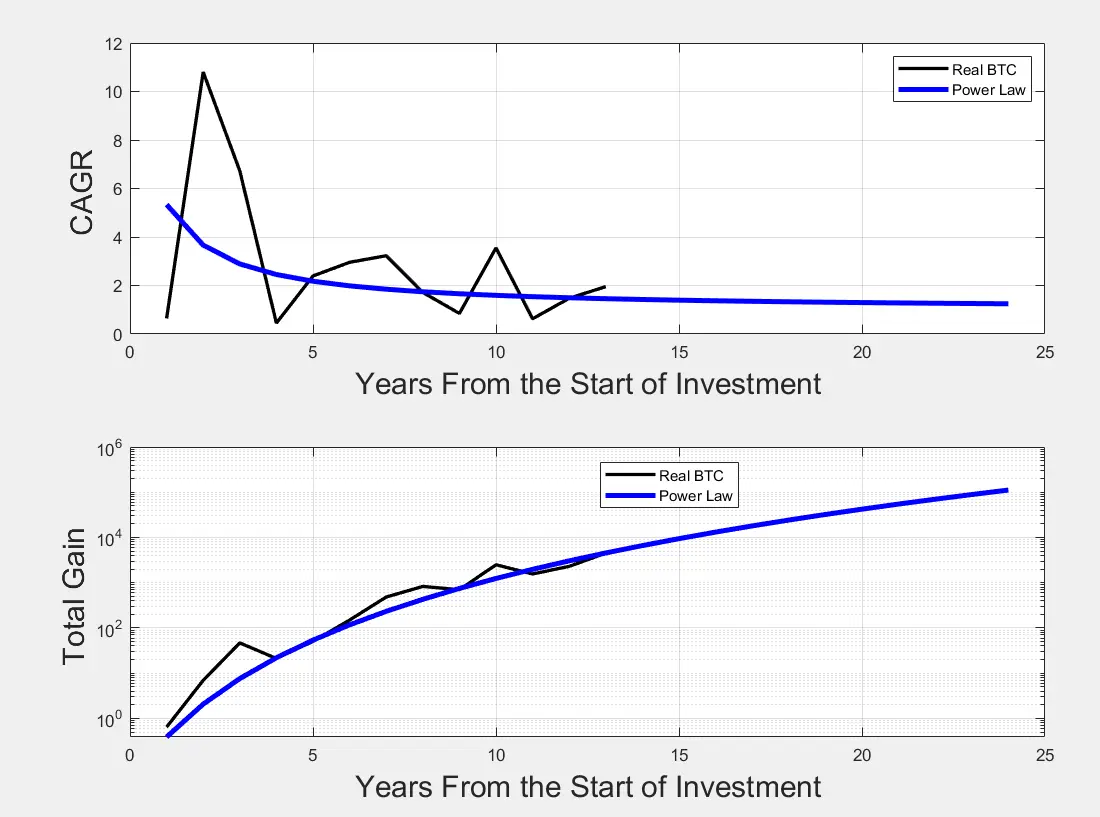

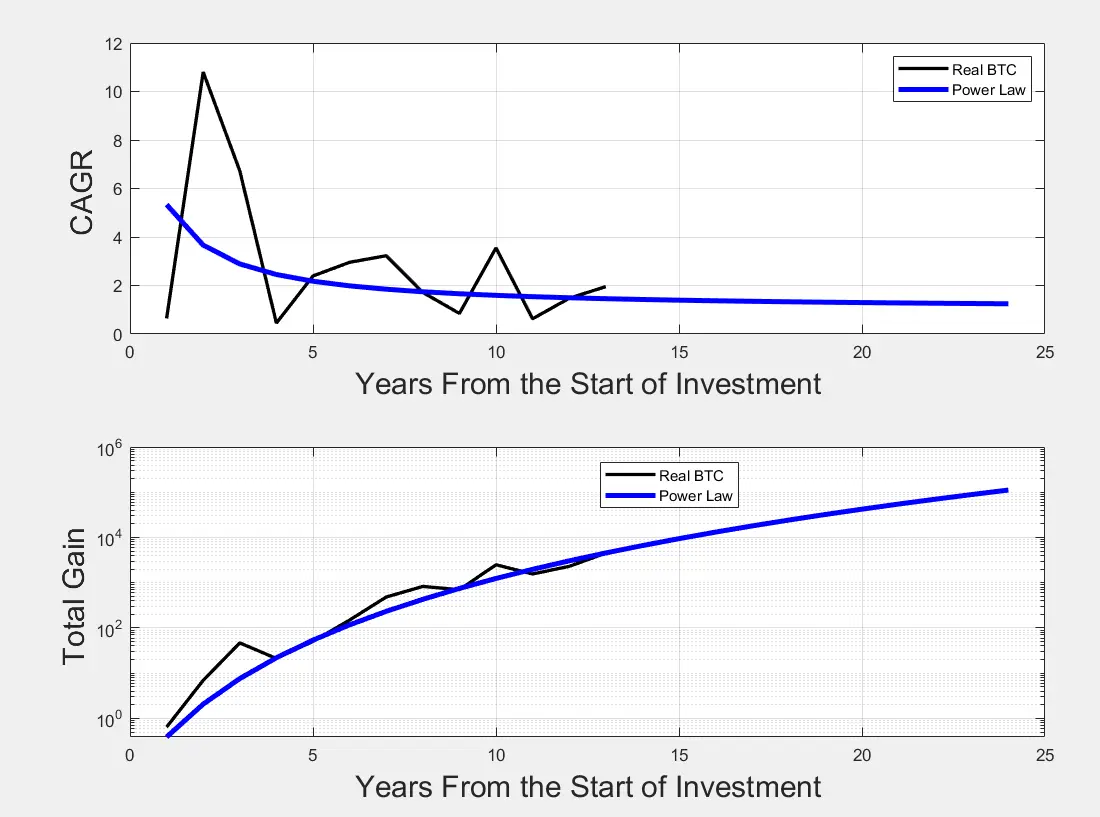

Here I compare the theoretical CAGR starting from year 3 projected to the future to the real averaged CAGR.

Also I show the total gain (cumulative product of the CAGR).

Again, see how well the theoretical model matches the real gains.

This goes beyond a mere fit of the data. It really shows the true scaling growth of the system.

Also I show the total gain (cumulative product of the CAGR).

Again, see how well the theoretical model matches the real gains.

This goes beyond a mere fit of the data. It really shows the true scaling growth of the system.

- Reward

- like

- Comment

- Share

Here a compare the theoretical CAGR starting from year 3 projected to the future. Also show the total gain (cumulative product of the CAGR).

Again, see how well the theoretical model matches the real gains.

This goes beyond a mere fit of the data. It really shows the true scaling growth of the system.

Again, see how well the theoretical model matches the real gains.

This goes beyond a mere fit of the data. It really shows the true scaling growth of the system.

- Reward

- like

- Comment

- Share

I made a post about future gains for Bitcoin.

To show how the theoretical model fits so well the real data I do the same here with previous gains. I smoothed the real CAGR over a 4 year average and calculated the cumulative gains.

You can see the theoretical model of the gains fits well the real data.

By the way if you started from year 3 of Bitcoin birth you would have gained a factor 100,000x after 22 years.

To show how the theoretical model fits so well the real data I do the same here with previous gains. I smoothed the real CAGR over a 4 year average and calculated the cumulative gains.

You can see the theoretical model of the gains fits well the real data.

By the way if you started from year 3 of Bitcoin birth you would have gained a factor 100,000x after 22 years.

- Reward

- like

- Comment

- Share

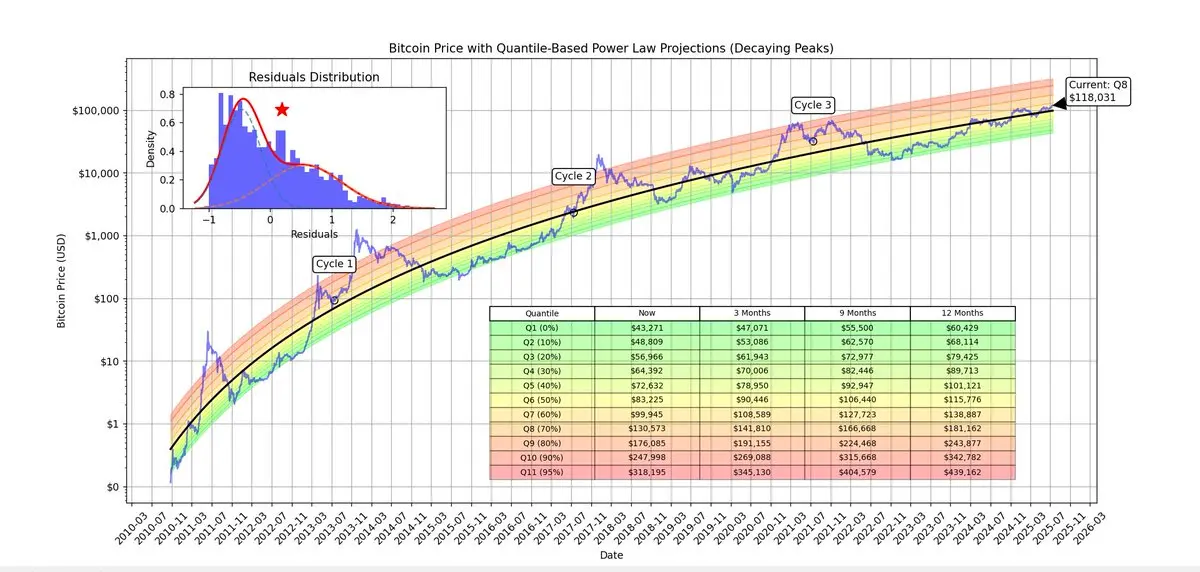

Bimodal Power Law Quantile fitting.

The little black circles show where we were at this time of the year in previous cycles for comparison.

The red star in the inset shows the current deviations relative to the bimodal distribution.

It is bimodal because Bitcoin has a 2 types of deviations the ones from the power law core (below the general trend) and the one above that tend to have a longer tail.

Notice the 2 curves indicating the 2 distributions and an overall red curve being the mixed model of these 2 distributions.

3 months from now Quantile 0.85 predicts a peak at 200K.

The little black circles show where we were at this time of the year in previous cycles for comparison.

The red star in the inset shows the current deviations relative to the bimodal distribution.

It is bimodal because Bitcoin has a 2 types of deviations the ones from the power law core (below the general trend) and the one above that tend to have a longer tail.

Notice the 2 curves indicating the 2 distributions and an overall red curve being the mixed model of these 2 distributions.

3 months from now Quantile 0.85 predicts a peak at 200K.

- Reward

- like

- Comment

- Share