DaoResearcher

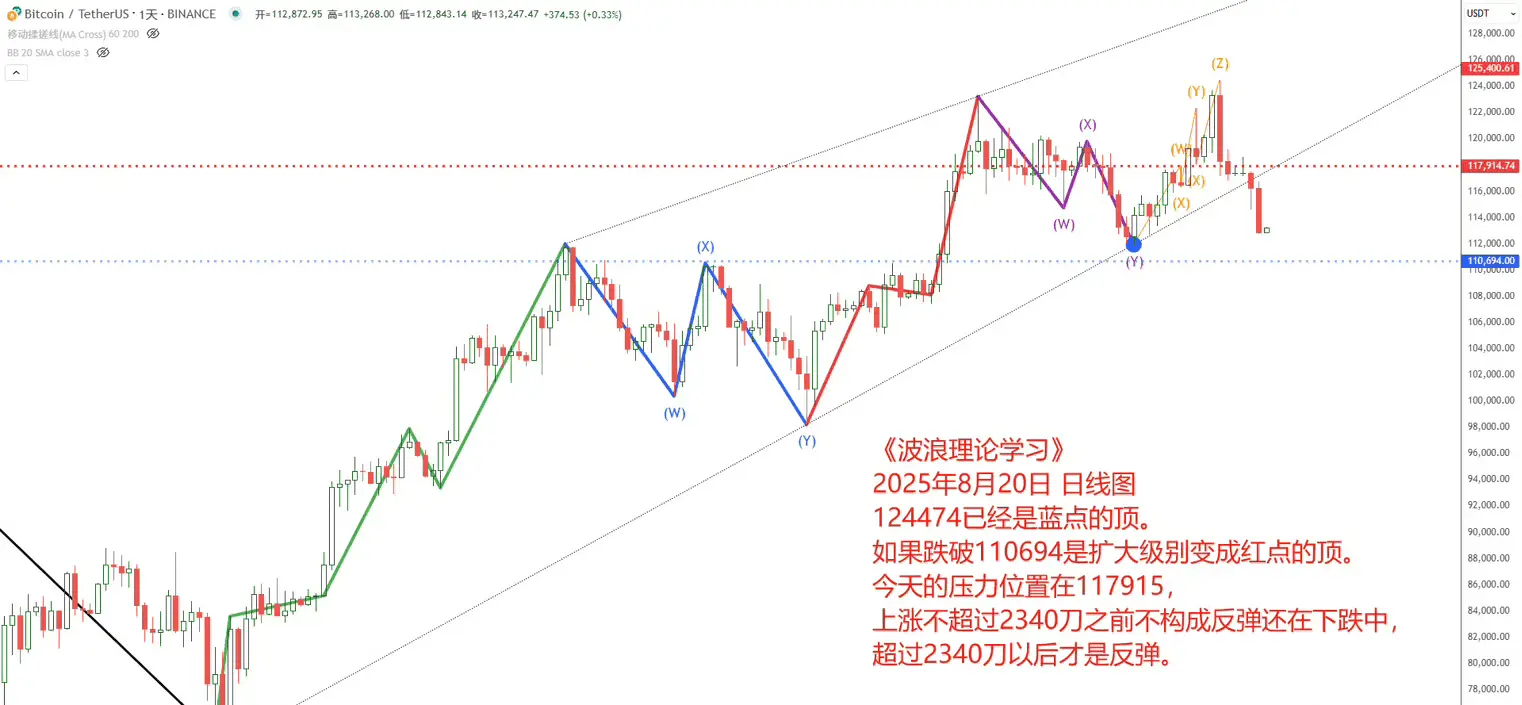

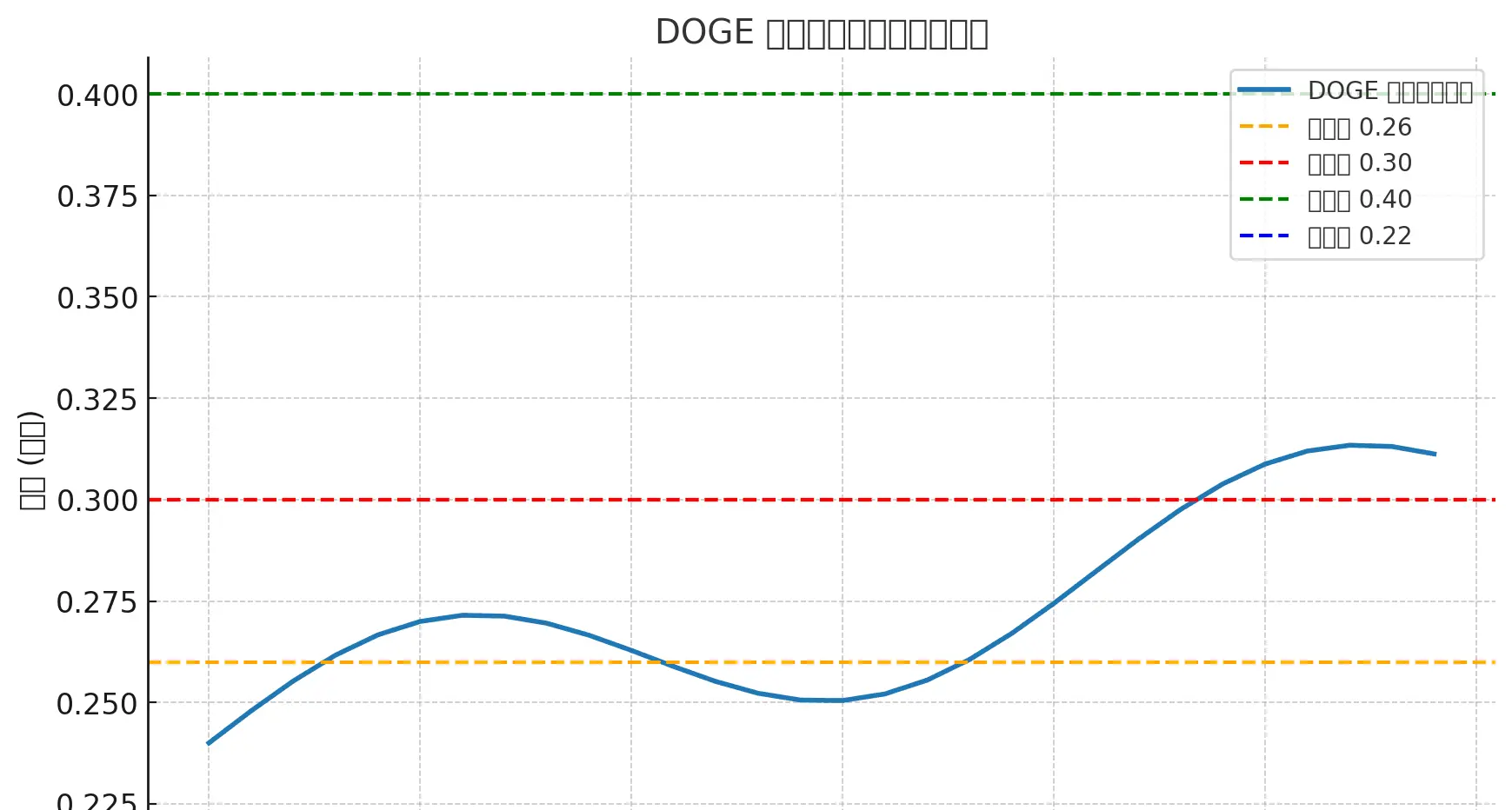

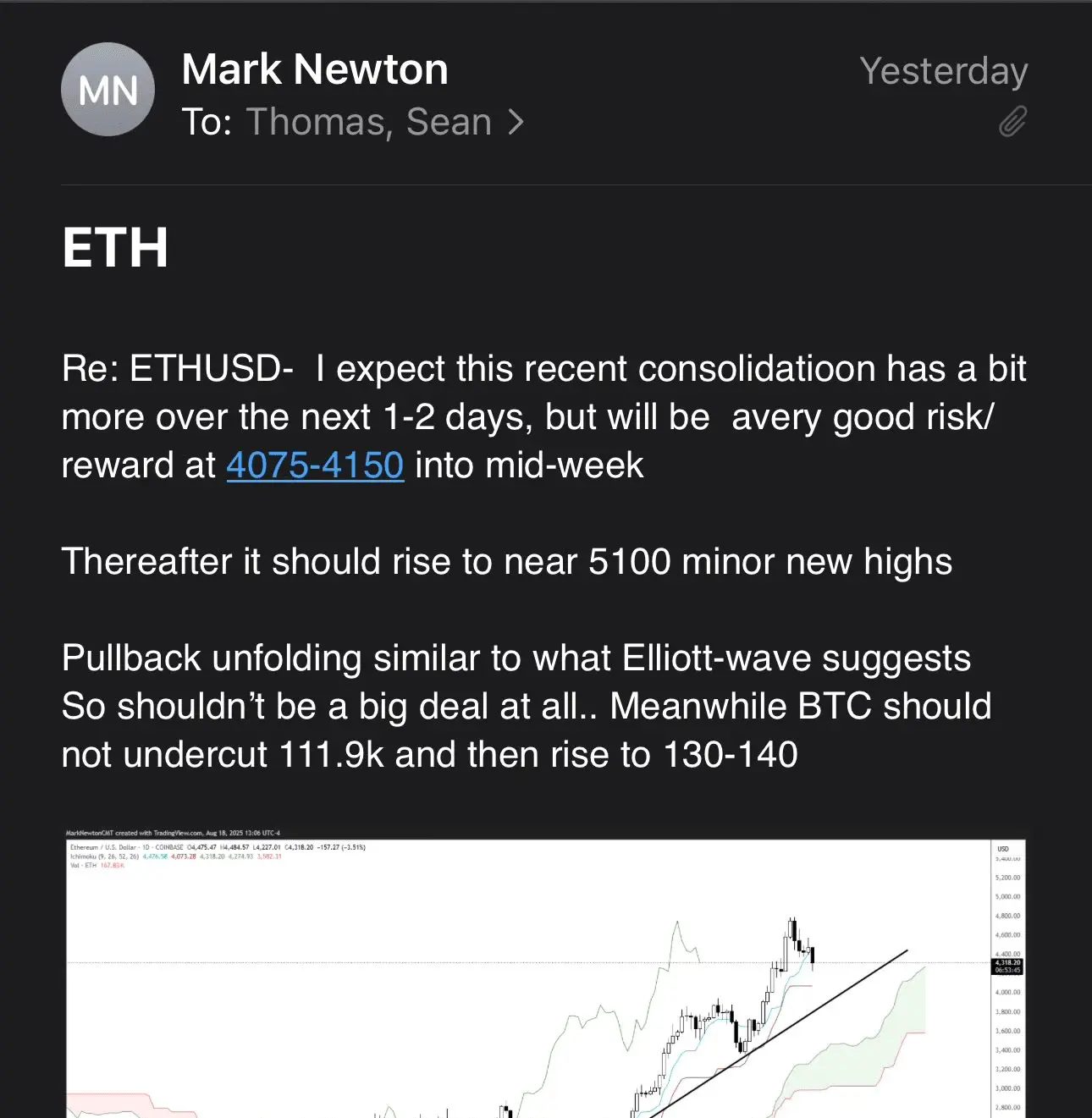

Recently, the crypto assets market is flooded with various predictions about the price movement of mainstream tokens such as Bitcoin, Ethereum, and Solana. However, these so-called "experts" predictions often lack reliability, and blindly following them may lead to significant losses for investors.

In fact, it is extremely difficult to accurately predict the price movement of crypto assets in the short term. It is very much like guessing heads or tails when flipping a coin, there is a lot of randomness involved. Especially in ultra-short-term trading, the role of technical analysis is very lim

View OriginalIn fact, it is extremely difficult to accurately predict the price movement of crypto assets in the short term. It is very much like guessing heads or tails when flipping a coin, there is a lot of randomness involved. Especially in ultra-short-term trading, the role of technical analysis is very lim